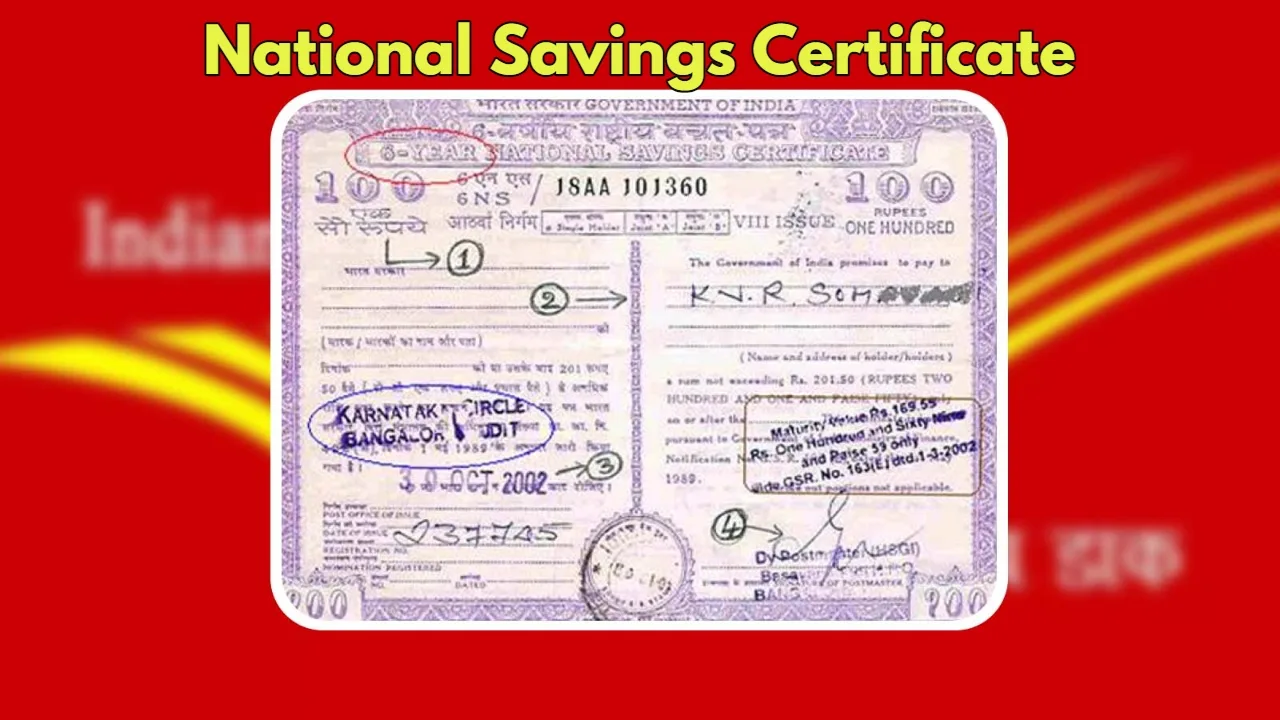

NSC Scheme 2025: If you are an investor who does not like to take risks, even if the returns are not as high as the market, then some savings schemes of the Government of India with guaranteed returns are considered to be the best for you. One of these is the Post Office National Savings Certificate (NSC) scheme. In this scheme, you get better returns and, most importantly, your invested money is completely safe. You can easily open an NSC account by visiting your nearest post office branch and start investing. Let’s understand this great savings scheme in detail and know how it can help you achieve your financial goals.

Who can invest in NSC?

According to the official website of India Post, the eligibility to open an account under the National Savings Certificate Scheme is very simple and inclusive:

Any adult can open an NSC account in his/her name.

Three adults can also open a joint account together.

A guardian can open an account on behalf of a minor.

Minor above 10 years: If a minor has completed the age of 10 years, they can also open an NSC account in their name.

The guardian can also open this account on behalf of a mentally ill person. Now this account is also called ‘authorized account’.

The special thing about this scheme is that you can open as many accounts as you want according to your convenience and financial goals. Investment in Post Office NSC can be started with a minimum of ₹ 1000, while you can invest any amount in multiples of ₹ 100. There is no upper limit on the maximum investment, making it suitable for both small and large investors.

How much return is available on NSC

Currently, an annual interest rate of 7.7 percent is being offered on deposits in the Post Office National Savings Certificate Scheme. This interest rate is much higher than many bank FDs, giving you better returns on your investment. If you invest ₹10,000 today, you will get ₹14,490 on completion of the maturity period of 5 years. This means you get a net return of ₹4,490, which is a great way to grow your money in a safe manner.

Premature Withdrawal Conditions

As per the rules of India Post, the NSC account cannot be closed before maturity. However, there are some special circumstances in which it may be allowed. It is essential to understand the rules so that you do not suffer any loss:

Premature closure before the period of 1 year

If the account is closed before the completion of a period of one year from the date of deposit, you will get back only the principal amount. You will not get any interest during this period.

Closure between 1 and 3 years

If the account is closed after one year from the date of deposit but before completion of 3 years, you will be paid interest equal to the interest rate applicable on the Post Office Savings Account from time to time. Currently, a savings account gets only 4% interest, so you will get only 4% interest instead of 7.7%, which can be a big loss.

The post Post Office NSC Scheme 2025: Earn 7.7% Guaranteed Returns – Know Eligibility, Benefits & Withdrawal Rules appeared first on Times Bull.

from Times Bull https://ift.tt/4tGJ1sk

0 Comments